With our global VAT and sales tax expertise and technology, we simplify registration, filing, analytics, and compliance.

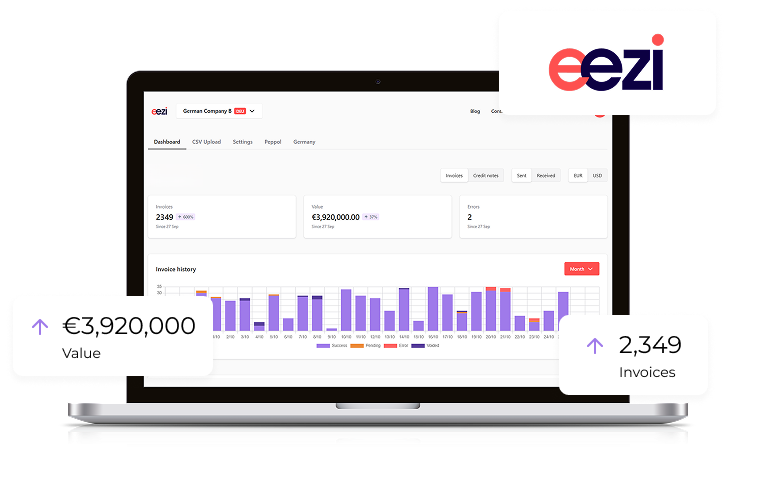

eezi is a seamless global e-invoicing solution that simplifies compliance and keeps you ahead of evolving mandate changes.

Reclaim foreign and domestic VAT with ease allowing your business to boost cash flow, cut costs, and fund growth worldwide.

Discover your e-invoicing obligations, helping you stay ahead of regulatory requirements worldwide.

Evaluate your VAT reclaim potential based on your annual Travel & Entertainment expenditure.

Navigate the intricacies of your invoices. Use our interactive tool to find out what is required to optimise your claims.

Your go-to hub for news, thought leadership and practical guides across VAT reclaim, VAT and sales tax compliance, and e-invoicing.

E-Invoicing in France: Updates on the B2B and B2C Mandate France is making steady progress on its digital invoicing reform, despite a shift in the official timeline. Originally planned for 2024, the mandatory B2B and B2C e-invoicing will now begin in September 2026, giving businesses more time to prepare, but also raising expectations for compliance. […]

Claiming VAT in the accounting industry Explore the reclaim opportunities available within the industry Within the accountancy industry, there is very little room for error. Every cent is accounted for, and financial visibility is a key priority. However, even within a sector that is tapped into the intricacies of value-added tax and its impact on […]

VAT vs Sales Tax: A practical business guide On the surface, VAT and sales tax are virtually the same. They’re both indirect taxes on the sale of goods or services. However, from a business and accounting perspective, there are important distinctions that affect compliance, cash flow and profit. For businesses entering new markets, understanding the […]