This guide provides an overview of VAT in Belgium, including applicable rates, registration requirements, compliance obligations, and filing deadlines. It is designed for businesses engaging in transactions within Belgium.

Belgium was one of the first six EU countries to adopt VAT back in 1971.

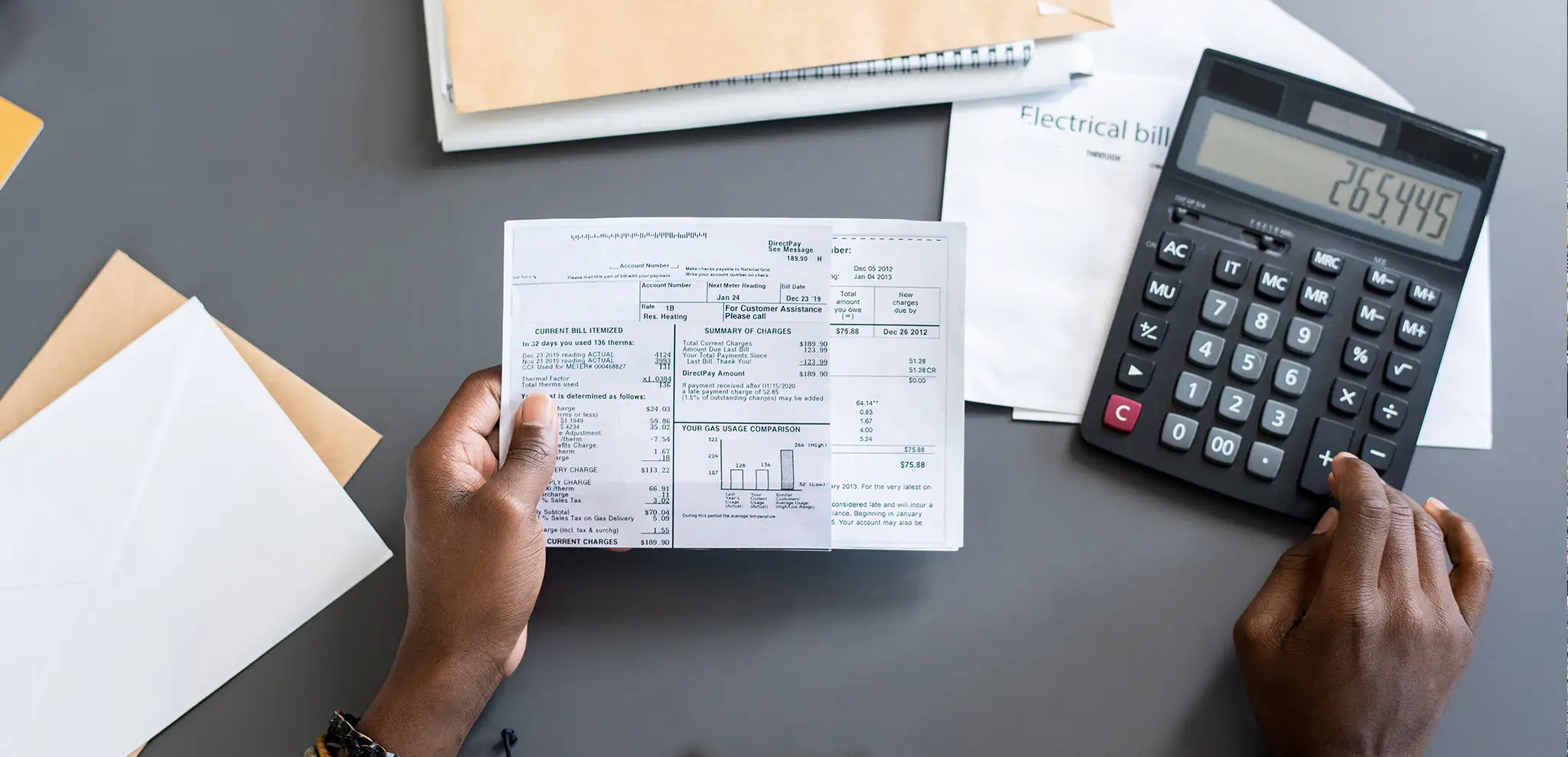

Foreign businesses incurring expenses in Belgium? You might be eligible for a VAT refund.

Doing business in Belgium? You’ll need to play by the rules of the Value Added Tax Code and Royal Decrees.

Registration is generally required for businesses above the VAT threshold. However, businesses below the threshold can also register voluntarily.

Belgium applies VAT on digital services based on the consumer’s location, generally utilizing the OSS system for cross-border services within the EU.

Yes, non-established EU businesses can reclaim Belgian VAT under the EU VAT refund scheme.

No. The current mandate only applies to domestic B2G transactions within Belgium. B2B and cross-border e-invoicing are not yet mandatory.

The mandate applies to all VAT-registered taxpayers in Belgium that supply goods or services to Belgian public sector entities.

Explore indirect tax information in these countries:

E-Invoicing in France: Updates on the B2B and B2C Mandate France is making steady progress on its digital invoicing reform, despite a shift in the official timeline. Originally planned for 2024, the mandatory B2B and B2C e-invoicing will now begin in September 2026, giving businesses more time to prepare, but also raising expectations for compliance. […]

Claiming VAT in the accounting industry Explore the reclaim opportunities available within the industry Within the accountancy industry, there is very little room for error. Every cent is accounted for, and financial visibility is a key priority. However, even within a sector that is tapped into the intricacies of value-added tax and its impact on […]

VAT vs Sales Tax: A practical business guide On the surface, VAT and sales tax are virtually the same. They’re both indirect taxes on the sale of goods or services. However, from a business and accounting perspective, there are important distinctions that affect compliance, cash flow and profit. For businesses entering new markets, understanding the […]

E -Invoicing in Egypt: A New Chapter in Digital Taxation Egypt is undergoing a digital evolution in the world of tax, and it’s reshaping the way businesses handle invoicing. At the heart of this transformation is the Egyptian Tax Authority’s (ETA) e-invoicing and e-reporting initiative, a broad-scope mandate that aims to close VAT gaps, increase […]

A pocket guide to reclaiming VAT from the UK Great – you’ve got stacks of VAT recovery opportunities waiting to be reclaimed. Except for one tiny problem: you do not know where to begin. We don’t blame you. VAT reclaim (especially from the UK) is no easy feat. Not only do you have to absolutely […]